News

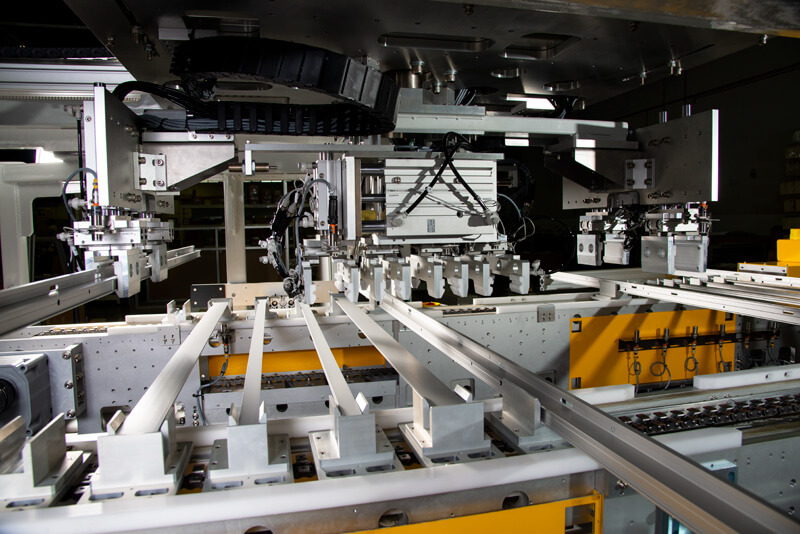

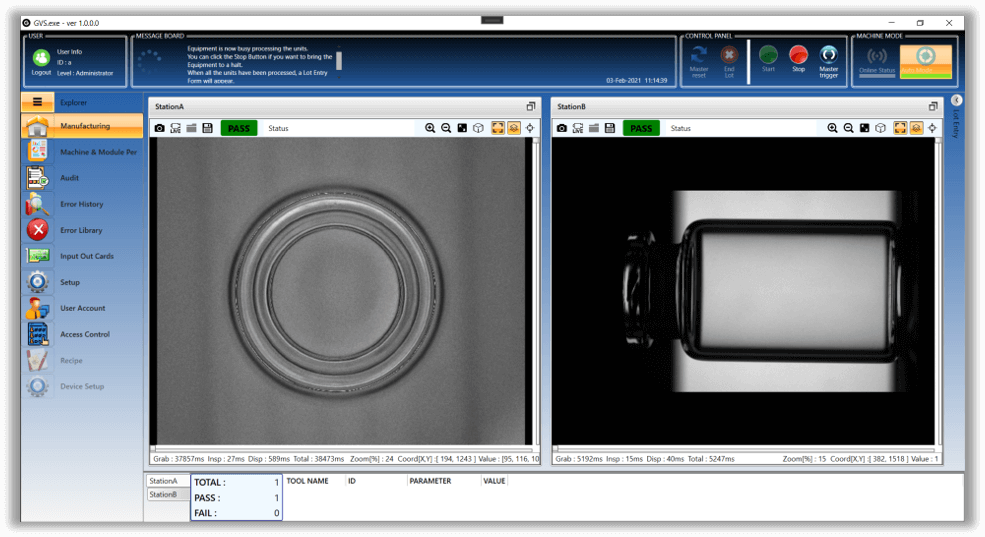

Greatech represents a significant breakthrough in cost-effectiveness, connectivity, and customization in vision systems.

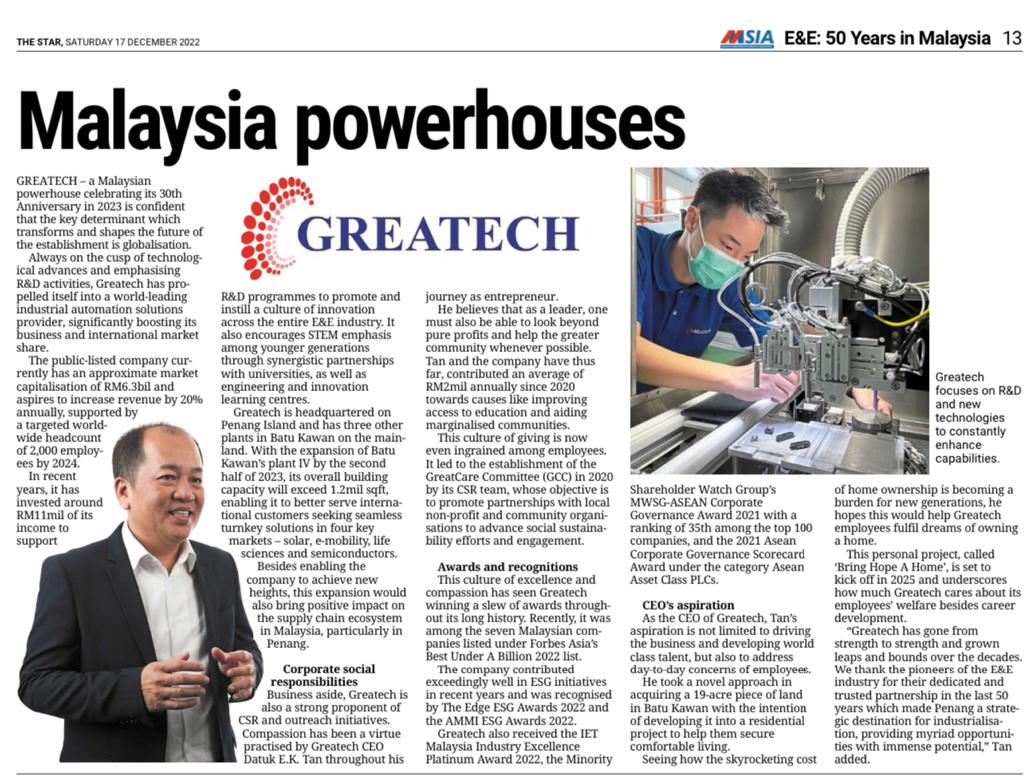

Dato EK Tan feel grateful as a power house of E&E – the STAR reported 17th December 2022. With the continuous...

KUALA LUMPUR (August 11): Seven Malaysian companies have made it to the Forbes Asia’s Best Under A Billion 2022 list....

AS its name implies, a semiconductor chip is made of a material that conducts current, but not completely. The conductivity...

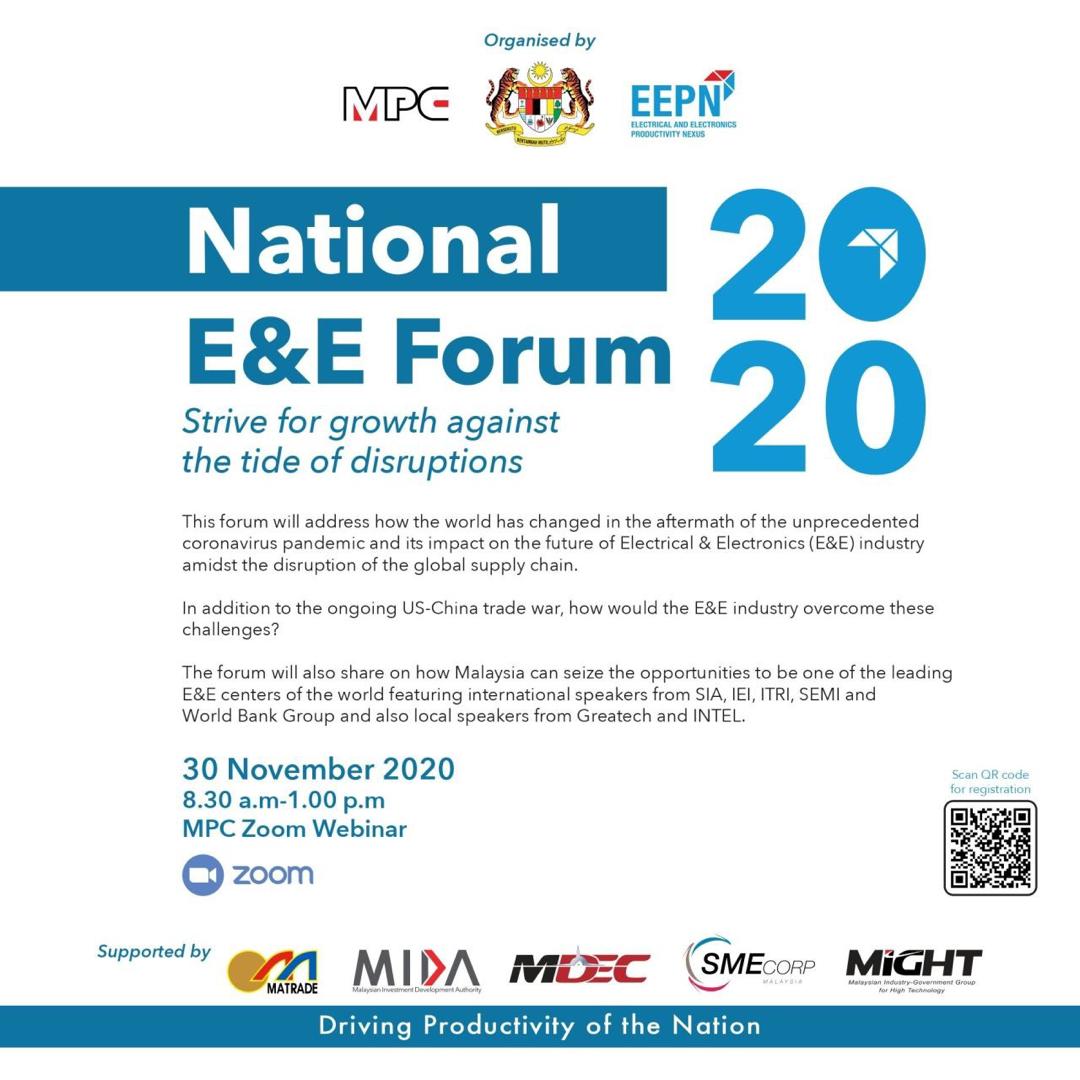

Greatech is honoured to be a part of the National E&E Forum 2020 online! Our CEO Mr Tan Eng Kee...